We use cookies on this site to enhance your experience.

By selecting “Accept” and continuing to use this website, you consent to the use of cookies.

Research by Wendy Wu, associate professor in the Department of Economics, is helping to unravel the mysteries of financial economics.

Her recent publication, Canadian Shadow Banks and Monetary Policy Effectiveness, co-authored with Jeremy M. Kronick, uses Canadian financial market data to analyze the link between monetary policy and the growth of shadow banks and, by extension, financial stability in Canada.

Shadow banks, such as investment funds, hedge funds and mortgage finance companies, have grown rapidly in recent years. Their research finds that monetary policies are not as effective on shadow bank loans as on chartered bank loans. This suggests that as shadow banks have grown in importance, the effectiveness of monetary policy in reducing inflation has been impaired. These results provide new insights into Canadian shadow banking trends and monetary policy that can inform federal and provincial regulators.

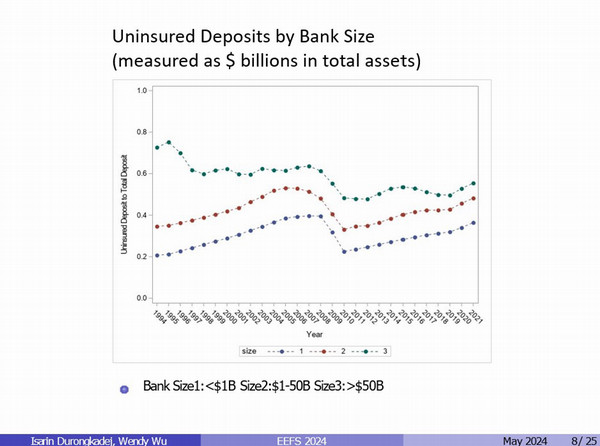

One of Wu's latest projects focuses on indentifying important factors contributing to the 2023 regional bank crisis in the United States. She presented "Bank Uninsured Deposits, CEO Compensation, and Regulations" at the European Economics and Finance Society Annual Conference this past June in Athens, Greece. While a recent Federal Reserve report points to high levels of uninsured deposits and failure to manage bank risk as contributing factors to the acceleration of regional bank runs in 2023, Wu's research is the first empirical investigation to test the relationships between uninsured deposits, bank executives' risk-taking incentives, and bank regulations in the United States.

Chart showing how uninsured deposits as a share of total deposits

changes over time, by bank size.